BTC Futures Open Interest Hits $23B, Binance Captures Lion’s Share, Signals Say 43% Chance of $64K Bitcoin by Month’s End

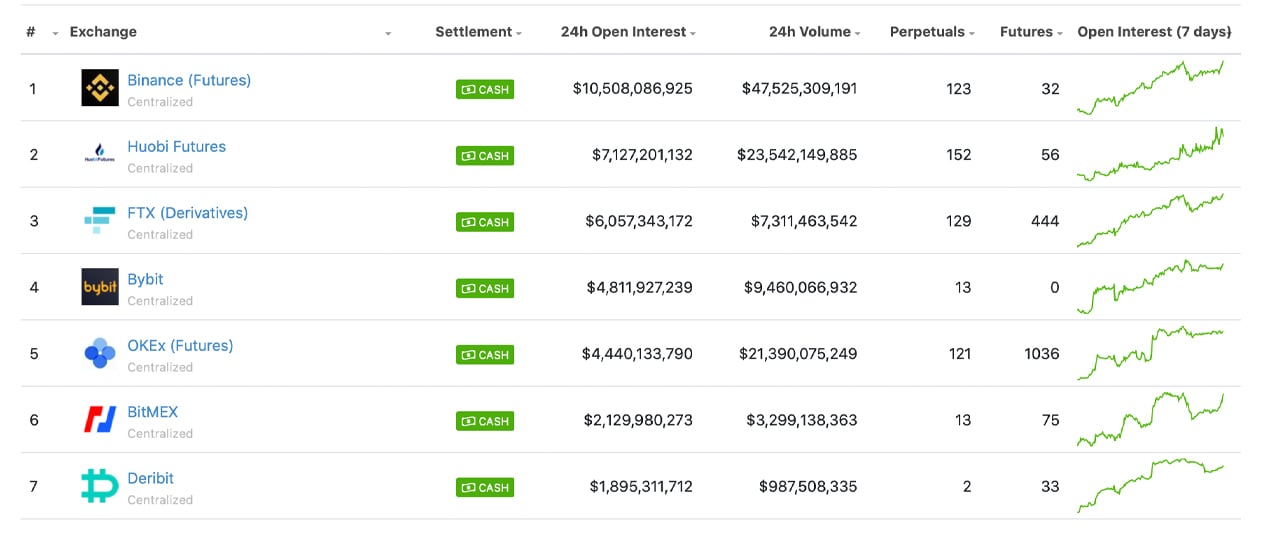

Bitcoin futures open interest on Monday has crossed $23 billion according to data recorded on April 5. The crypto asset exchange Binance has taken the lead as far as open interest in bitcoin futures is concerned with a massive $10.5 billion in open interest.

Binance Captures the Bitcoin Futures Lead

Not too long ago, Bitcoin.com’s newsdesk reported on CME Group capturing the lead as far as open interest in bitcoin futures. Today, that’s no longer the case, as Binance has jumped ahead of the pack as far as delivering futures derivatives products for BTC. Skew.com analytics indicates that Binance is ahead of Bybit, Okex, CME, Huobi, FTX, Deribit, Bitmex, Kraken, Bakkt, and Coinflex respectively. Binance, Huobi, Okex, and Bybit are also leaders when it comes to BTC futures daily volumes.

Coingecko data is a touch different and shows bitcoin futures 24-hour total volumes at around $22,984,388,835 on Monday. Stats show Binance has $10.5 billion in open interest and $47 billion in 24 hour daily volumes. According to Coingecko’s stats, the list of exchanges following Binance includes Huobi, FTX, Bybit, Okex, Bitmex, Deribit, Kucoin, Bitfinex, and Bitget in the top ten. Huobi captures $7.1 billion today in open interest while FTX Exchange commands a touch over $6 billion.

Insights from Glassnode have also noticed the massive bitcoin futures open interest this week. “Futures open interest has hit yet another all-time high of over $23.1B this week, with Binance and OKex representing the lion’s share with a combined total of 32% of all contracts,” Glassnode detailed on Monday.

“Keep in mind that large open interest can exacerbate market volatility in response to price corrections if leverage is unwound quickly. Interestingly, futures volumes have been in steady decline throughout March with this week being particularly quiet relative to volume in previous months,” researchers at Glassnode noted in the company’s weekly newsletter.

43% Chance Bitcoin Will Hit $64K by the End of April, Cboe Looks to Re-Enter the Bitcoin Futures Game

Delta Exchange CEO, Pankaj Balani says that according to bitcoin futures, BTC has a 43% chance the crypto asset will hit $64k by the end of April. “Let’s say BTC trades at $50k; then skew is the difference in implied volatility of, say, a $52k call and a $48k put,” Balani detailed in a note to Bitcoin.com’s newsdesk. “In the case of positive skew, traders are willing to pay more for an OTM call to gain upside exposure than for the equivalent put to protect themselves from falling prices. As such it can give us an insight into market participants’ expectations of spot price movements.”

Balani further added:

With BTC at the $59k level option markets give a 43% chance to $64k and 31% to $54k by the end of April. Except for a short spike during the recent price action realized volatility remains lower than implied. Looking at different time frames, traders are currently paying less for April options than for those expiring in May or June. Skew is approaching levels seen last time in mid-March when the spot broke $60k, indicating an overall optimistic positioning of market play.

In recent months bitcoin futures have been wild and have swelled in demand since the bull run started. Perpetual swaps and bitcoin options markets have grown enormously as well as Deribit is the king of the bitcoin options game today. Moreover, there have been call options for the price of BTC to hit $100k to $300k by December 31, 2021. Meanwhile, Cboe Global Markets CEO Ed Tilly explained that the firm may re-list BTC futures.

“We’re still interested in the space, we haven’t given up on it,” Tilly said in an interview published last Thursday. “We’re keen on building out the entire platform. There’s a lot of demand from retail and institutions, and we need to be there,” the Cboe executive added.

What do you think about the recent open interest in bitcoin futures spiking? Let us know what you think about the bitcoin derivatives market action in the comments section below.