Crypto Markets Lose Hot Air, DOGE and BCH Skyrocket, 46% Chance ETH Hits $2,600 by May

Digital currency markets have seen some slight losses on Friday morning, as a great number of cryptocurrencies saw significant gains the day prior. Bitcoin dropped to a low of $60,042 during the early morning trading sessions shedding 3% during the last 24 hours.

Crypto Markets Shed Some Value After Heating Up the Day Prior

Bitcoin (BTC) has dropped in value during the most recent trading sessions, as the price per BTC slid from $63,299 to $60,042 losing 5% in value. However, the price rebounded a hair and currently, BTC is exchanging hands between $60,900 to $61,100 per unit.

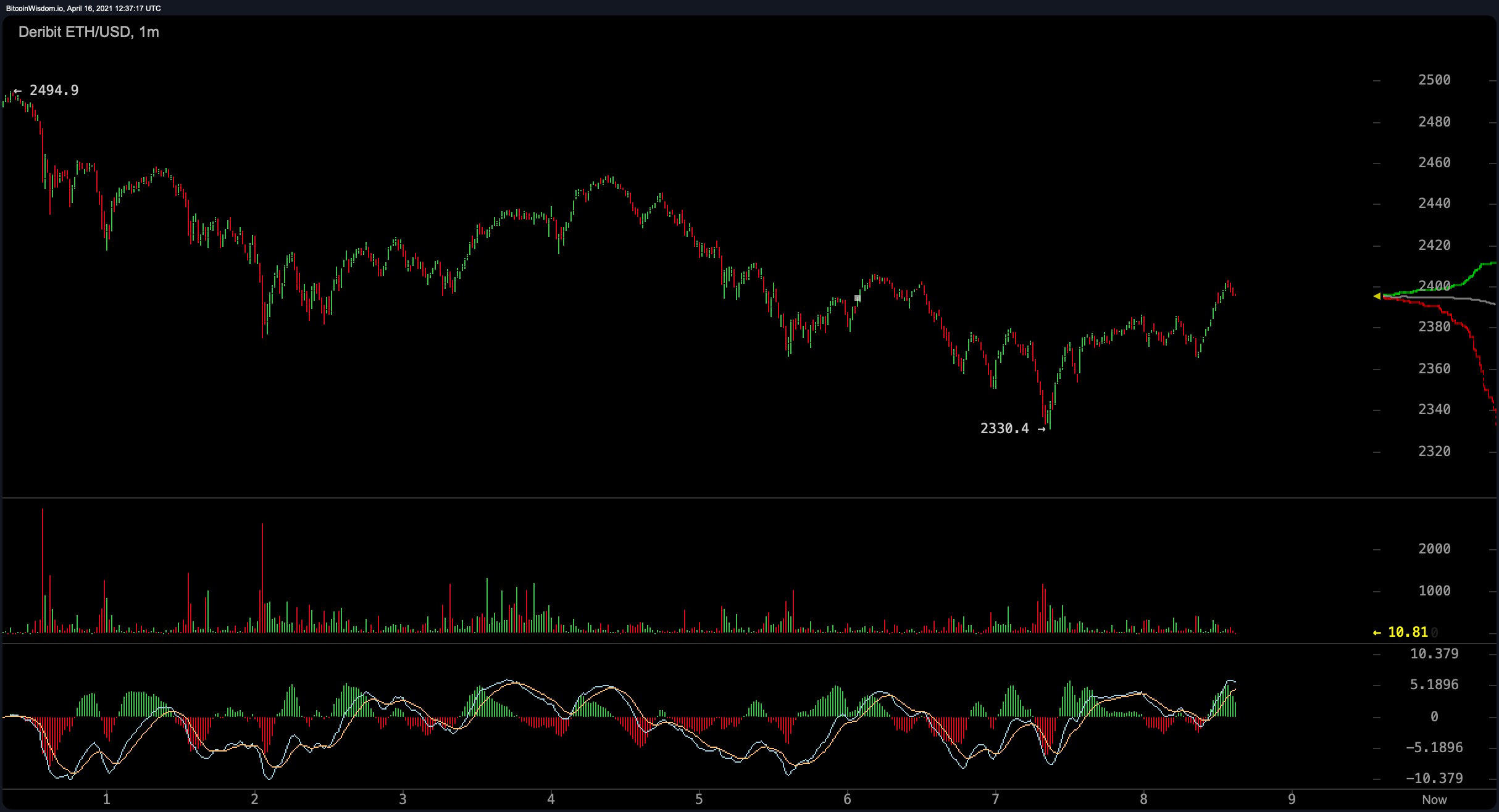

BTC is still up 3.86% today and 2.52% for the month. The second-largest market cap is ethereum (ETH) today and each coin is swapping for $2,374 per unit. ETH touched a high during Thursday evening’s trading sessions at $2,532 per ether.

Binance coin (BNB) is down over 5% today, as it was trading for $542 per unit last night and today it is swapping for $522. XRP has seen phenomenal gains during the last 48 hours and on April 14, XRP touched $1.94 per unit. Currently, XRP has lost some of those gains and each coin is swapping for $1.57 per coin. Cardano (ADA) is down more than 3% today and each ADA is trading for $1.39 per token.

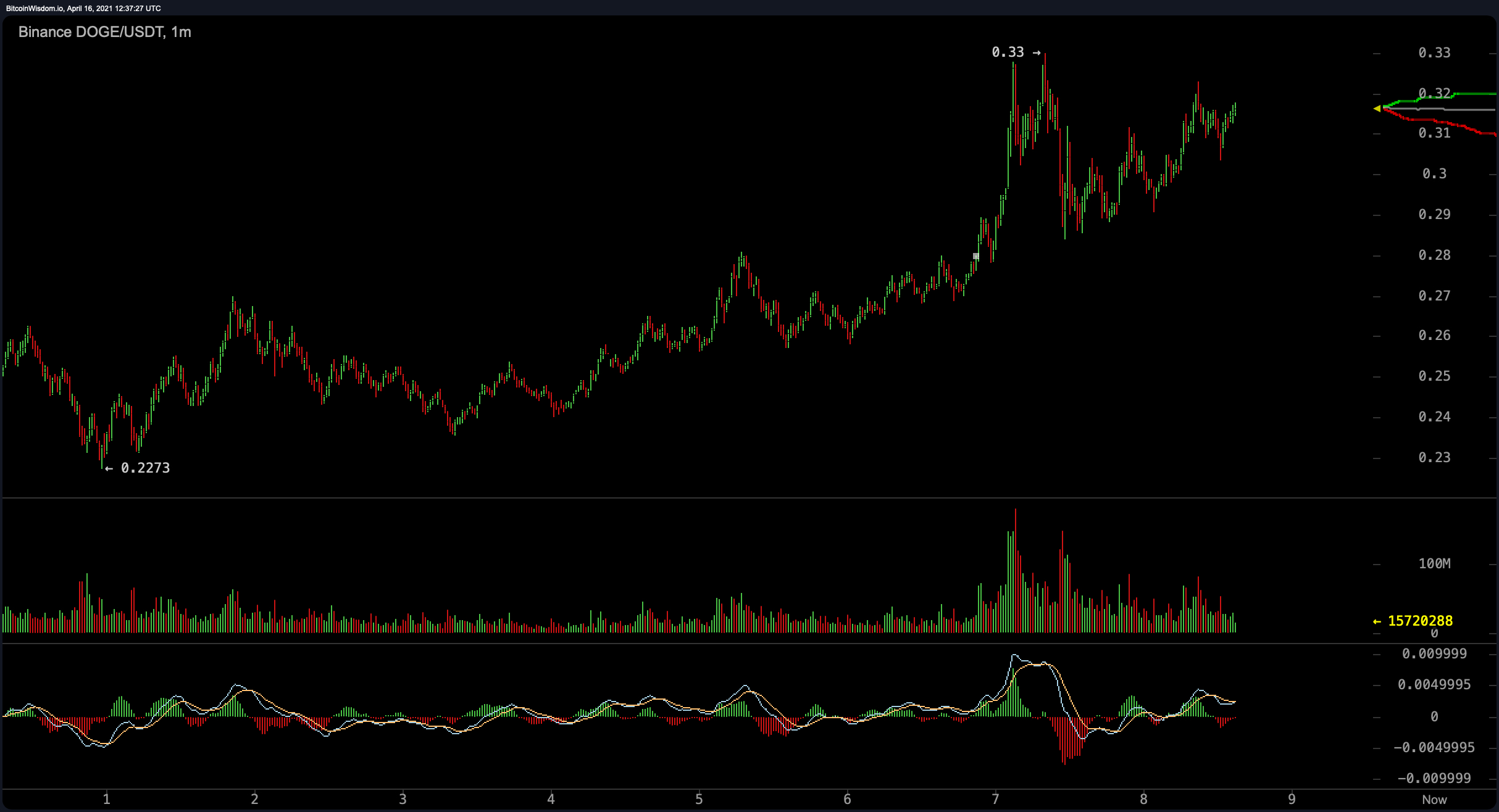

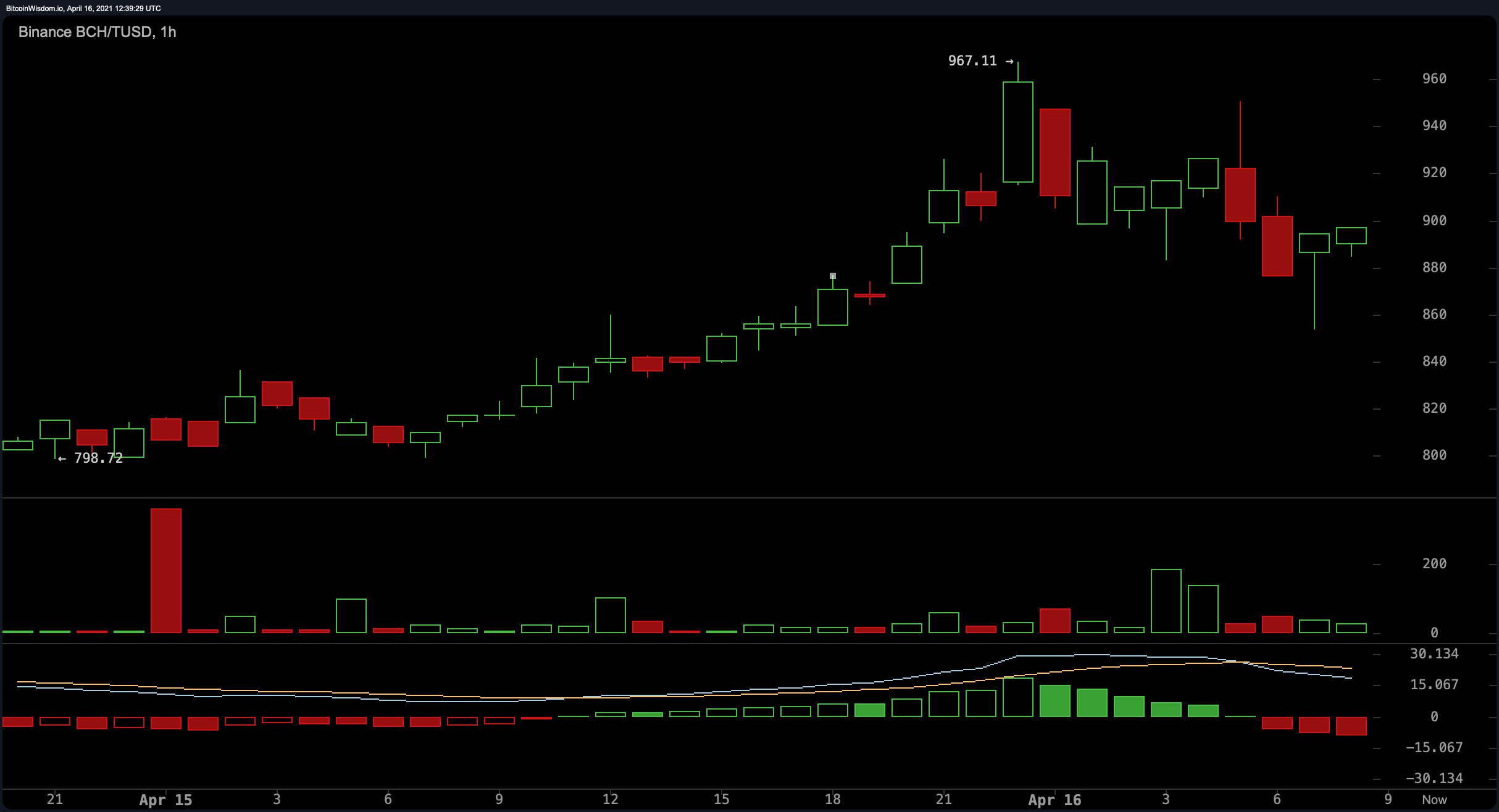

The last contenders in the leading pack of top-ten cryptos include polkadot (DOT) at $41.40, dogecoin (DOGE) at $0.30, uniswap (UNI) at $35.92, and bitcoin cash (BCH) is $894 per unit. Both dogecoin and bitcoin cash (BCH) have seen significant 24-hour gains as DOGE is still up 130.58% and touching new highs. BCH is up 7.45% and touched a high of $954 last night across global exchanges. At the time of publication, bitcoin cash is trading for $874 per coin and has a $16.98 billion market valuation.

Bitcoin Commands a Touch More Than Half of the and the $2.1 Trillion, Rest of the Market Is 9,261 Cryptocurrencies

During the evening trading sessions last night, crypto values were up quite a bit in value. The entire cryptocurrency market cap even surpassed the valuation of Apple (AAPL $2.258T). However, on Friday the crypto economy rests just below AAPL at $2.147T after a number of coins shed some value. Anton Chashchin, managing partner at Cex.io Prime Trading says that the crypto economy’s rising value shows how powerful these new assets can be.

“Developments like this mean that cryptocurrencies have become a full-blown investment asset class,” Chashchin said. “More and more we are seeing corporate, institutional, and high net worth investors moving towards crypto as a highly lucrative alternative investment opportunity. The increase in these savvy investors looking for reliable partners will only seek to further legitimise the industry and strengthen the market.”

Crypto Derivatives Markets Indicate Some Movements Going Forward

Yesterday, Pankaj Balani, CEO of Delta Exchange told Bitcoin.com News that there is a 40% chance BTC prices could tap $70k by the end of May in our update after Mike Novogratz warned of a crypto market “washout.” Speaking with Balani again on Friday, the derivatives exchange CEO explained the method behind his predictions and touched upon ETH prices as well.

“The options market is pricing in a 40% chance of $70k and 31% of $58k by the end of May,” Balani wrote. “Post the recent spike in bitcoin, the shorter-dated implied volatility (April, May) has started to trade higher and is only a tad bit short of that of June and September expiries. The market seems to be factoring in a big move here and we can expect the realized volatility to grind higher further,” the exchange executive added.

Pankaj Balani also gave his perspective on ethereum (ETH) prices by looking at the data from this week’s derivatives market action.

“The options market is pricing ETH at $2,600 with 46% probability and at $2,100 with a 29% probability for the month of May,” Balani told Bitcoin.com News. “Most traded contracts today are the $2,300 and $2,200 calls. There is a lot of demand to add to upside calls on Ether for the short to medium term. Realized volatility has caught up to implied volatility and the skew of calls over puts remains high,” he added.

What do you think about the crypto market action on Friday? Let us know what you think about this subject in the comments section below.