Bitcoin vs. digital fiat is freedom vs. serfdom

Bitcoin, as decentralized and censorship-resistant money, protects financial sovereignty from monetary subjugation by CBDCs and stablecoins and defends against the failures of financial institutions.

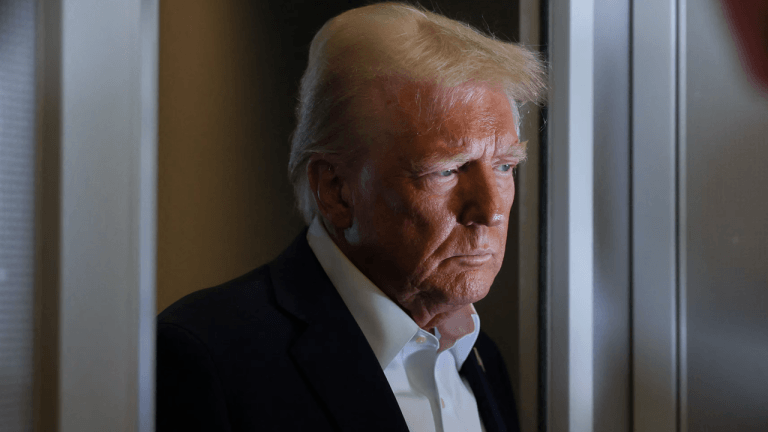

Opinion by: Simon Cain, contributor at Bitcoin Policy UK

Most jurisdictions globally are researching, developing or implementing retail central bank digital currencies (CBDCs). If you see these as harmless move-with-the-times digital updates of old-fashioned paper money, look again. CBDCs potentially mean financial serfdom via a monetary panopticon where the authorities closely control every transaction.

If you think this sounds paranoid, just consider the words of Augustin Carstens, head of the Bank for International Settlements — the central bank for the world’s central banks. Lamenting the authorities’ current inability to control cash transactions, he says that with a CBDC, a “central bank will have absolute control on the rules and regulations that will determine use… also we will have the technology to enforce that.. that makes a huge difference with respect to what cash is.”